How the 50:30:20 Rule Meets the Needs of a Family's "Big Budget" ?

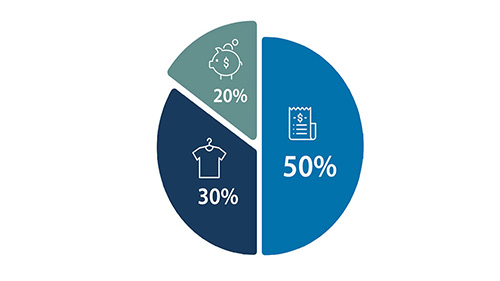

A lot of families are looking for budgeting techniques that work and can be adjusted to fit their everyday routines. The 50:30:20 rule, a straightforward yet efficient structure for handling after-tax income, is among the most advised strategies. You set aside half of your money for necessities under this strategy. This guarantees dependable monthly coverage of your family's essential living costs.

Next, set aside 30% for "want" items—this can include dining out, entertainment, hobbies, vacations, or small luxuries that bring joy and comfort. Allocating a portion for discretionary spending helps avoid feelings of scarcity and makes the budget more sustainable over the long term. Finally, set aside 20% for savings or debt repayment. This might include contributing to an emergency fund, retirement account, or paying down credit cards and loans. This approach encourages financial discipline while leaving room for enjoyment, striking a balance between living in the present and preparing for the future.

The Rise of Budgeting

While structured budgeting is crucial, another trend is emerging: budgeting out loud. This concept emphasizes transparency, communication, and accountability in financial matters. Unlike traditional budgeting, which is often private and sometimes stressful, budgeting out loud encourages open discussions among family members about their financial goals, spending limits, and challenges, and when appropriate, with friends and family.

The term was popularized by TikTok influencer Lukas Battle, who emphasizes that openly sharing financial intentions can reduce social pressures to overspend. For families, this means communicating openly about, for example, why you can't contribute to a friend's expensive event or why a major purchase has been postponed. An open budget fosters a sense of collective responsibility and understanding, reducing conflict and making financial planning feel like a shared family project rather than a solitary chore.

Combining Structure with Transparency

The real power emerges when families combine the 50:30:20 rule with budgeting out loud. Using the 50:30:20 framework provides a clear, measurable structure for income allocation, while budgeting out loud ensures that these allocations are respected through open communication and social accountability. For example, a family might decide that 30% of their "wish" budget includes birthday celebrations, but through open discussion, everyone is clear about boundaries and avoids unnecessary pressure.

Adopting the 50:30:20 rule and a robust budgeting strategy can fundamentally transform how families manage their finances. It empowers families to take control of their financial destinies, confidently navigate modern financial challenges, and develop habits that foster long-term stability. By streamlining budgeting through clear income allocation and increased transparency in financial discussions, families not only reap tangible financial benefits but also foster trust, cooperation, and understanding within the family.

In an age of constant and often overwhelming financial pressure, combining a structured budget with open dialogue offers a sustainable and family-friendly solution. It empowers every family member to actively participate in financial planning and reinforces the idea that managing money wisely isn't a solitary endeavor, but a shared journey toward security, freedom, and inner peace.

Recommended for you